Ongoing Financial Planning

Financial planning is about making decisions that support the life you want to live, not just today, but over time.

I provide ongoing financial planning to help you feel confident about your money and the choices you’re making. We work together to turn your goals into a clear, manageable plan and revisit it regularly as life changes.

This is a long-term relationship focused on clarity, progress, and support.

Areas I Help With

I work with clients across many areas of their financial lives, including:

Major life decisions and transitions

Retirement planning and working less

Education planning

Lifestyle and travel goals

Giving and legacy planning

Debt and cash flow management

You don’t need to have everything figured out. My role is to help you organize what you have, clarify what matters most, and make thoughtful decisions along the way.

Our Process

-

We talk through your goals, finances, and a few potential strategies to see if we’re a good fit.

-

You’ll use a secure portal to gather income, accounts, loans, property, insurance, and expenses so we have a clear picture of your financial life.

-

I analyze your information and create a personalized financial plan aligned with your goals.

-

We prioritize next steps and work through them together.

-

We meet up to three times per year to review progress, discuss upcoming decisions, and adjust your plan as life changes.

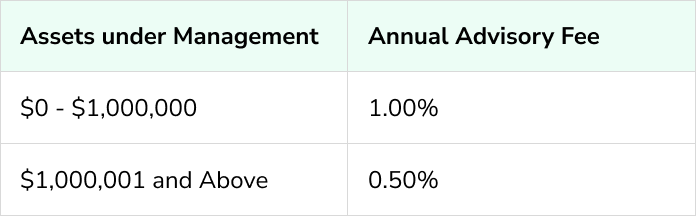

The investment

If you have investment accounts that are managed, advisory fees may be deducted directly from those accounts based on the schedule below: